SELINSGROVE, PENNSYLVANIA, UNITED STATES – 2021/01/27: The AMC Classic Selinsgrove 12 theatre at the … [+]

SOPA Images/LightRocket via Getty Images

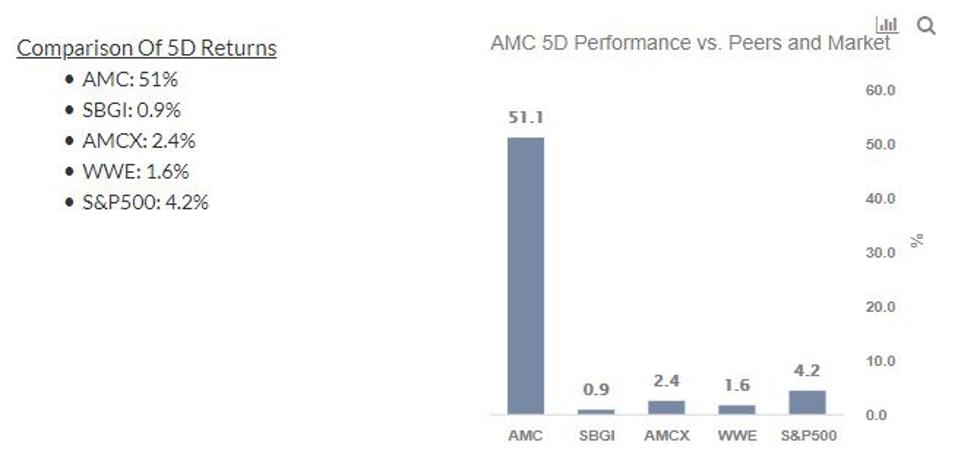

AMC Entertainment Holdings stock (NYSE: AMC) rallied an eye-popping 51% in just the last five trading days and has completely outperformed the S&P 500 which was up only 4%. The recent rally was led by the company’s FY2020 earnings announcement and business updates. The management announced that 89.5% of its domestic theaters are now open, while 22% of its international operations are functional. Also, theaters in critical markets like San Francisco and New York City have reopened with limited capacity. In addition to this, AMC is planning to open all its remaining 23 movie theaters in Los Angeles on March 19; pending approval, AMC said it hopes that all 53 California locations will be open by March 19. The Los Angeles market, in addition to being closer to the studios, is about double the size of the New York City market. This announcement comes after the company recently averted a possible bankruptcy by raising additional capital. It has raised over $900 million in the last three months – ($506 million from equity issuance in December 2020 and $411 million from debt raised from its European subsidiary Odeon. AMC has raised about $2.2 billion in debt and equity in the last one year. Thus, recent capital raising initiatives and gradual opening of theaters, along with successful vaccine rollout has led to expectations of AMC being in a reasonable position to capitalize on the pent-up demand of movie-goers, which took the stock 51% up in a week.

However, is AMC stock set to continue its upward trajectory or could we expect some correction? We believe, based on our machine learning analysis of trends in the stock price over the last seven years, AMC stock has a strong chance of a decline in the next one month (twenty-one trading days). See our analysis on AMC Stock Chances Of Rise for more details.

Five Days: AMC 51%, vs. S&P500 4.2%; Outperformed market

(Extremely rare event)

- AMC Entertainment Holdings stock rose 51% over a five-day trading period ending 3/15/2021, compared to a broader market (S&P500) rise of 4.2%

- A change of 51% or more over five trading days is an extremely rare event, which has occurred 15 times out of 1813 in the last seven years

MORE FOR YOU

Ten Days: AMC 53%, vs. S&P500 2.1%; Outperformed market

(Extremely rare event)

- AMC Entertainment Holdings stock rose 53% over the last ten trading days (two weeks), compared to broader market (S&P500) rise of 2.1%

- A change of 53% or more over ten trading days is an extremely rare event, which has occurred 14 times out of 1797 in the last seven years

Twenty-One Days: AMC 150%, vs. S&P500 1.7%; Outperformed market

(Extremely rare event)

- AMC Entertainment Holdings stock rose 150% the last 21 trading days (one month), compared to a broader market (S&P500) rise of 1.7%

- A change of 150% or more over 21 trading days is an extremely rare event, which has occurred 5 times out of 1755 in the last seven years

Out of 15 instances in the last seven years that AMC Entertainment Holdings stock saw a five-day rise of 51% or more, 8 of them resulted in AMC stock rising over the subsequent one-month period (21 trading days). However, AMC stock has seen extreme volatility in the last two months, with the stock also seeing an increase of 600% in a matter of days due to short squeezes. With the stock already seeing high activity and volatility, we believe that it is more likely to see a decline after a 51% rise in a week.

While AMC stock may have moved a lot, 2020 has created many pricing discontinuities which can offer attractive trading opportunities. For example, you’ll be surprised how the stock valuation for Netflix vs Tyler Technologies shows a disconnect with their relative operational growth. You can find many such discontinuous pairs here.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

from WordPress https://ift.tt/3eOllur

via IFTTT

No comments:

Post a Comment