What happened

The stock of AMC Entertainment Holdings (NYSE:AMC) continued the wild ride Monday that started with Reddit’s WallStreetBets investors last month. Shares of AMC dropped after a major shareholder converted share classes allowing it to cash out. Shares were down 12% as of 11:55 a.m. EST.

So what

AMC revealed in a U.S. Securities and Exchange Commission (SEC) filing that on Feb. 1, Wanda America Entertainment, a unit of China’s Wanda Group, converted its AMC Class B shares into Class A shares, “in order to permit sales of its common stock.”

The Feb. 5 filing did not reveal the number of shares that were converted. Wanda Group is a parent organization of AMC Theatres and shareholder of AMC Entertainment. It also did not report that the organization had sold any shares.

Image source: Getty Images.

Now what

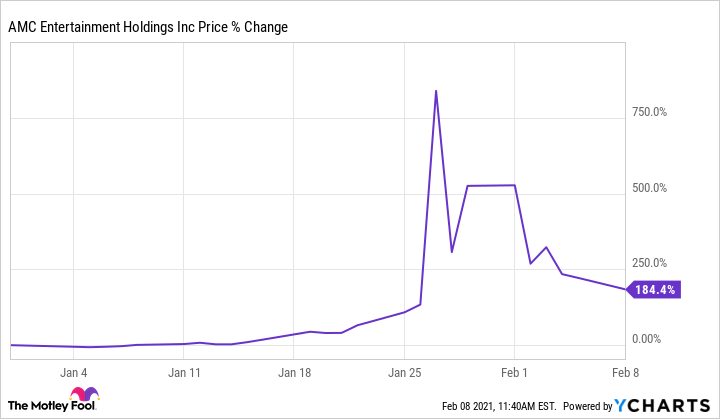

Investor reaction today seems to indicate a view that if a major shareholder may be cashing out, other investors should, too. Even after a more than 70% drop off recent highs related to the Reddit frenzy, AMC shares are still up over 180% from where they began 2021.

The company itself has raised much needed capital during the stock price rise. AMC announced a new equity offering raising $305 million on Jan. 27. After a year of pandemic-induced theater closures and movie release delays, AMC needed to strengthen its balance sheet. The money raised should allow the company to avoid bankruptcy, its CEO said in a statement on Jan. 25. But the dilution comes at a cost for existing shareholders, and some continue to take advantage of the recent rise in the stock.

from WordPress https://ift.tt/3aGKgfK

via IFTTT

No comments:

Post a Comment