NEW YORK, NEW YORK – MARCH 09: People walk outside the AMC Empire 25 movie theater in Times Square … [+]

Getty Images

“They don’t know what they’re doing…and they don’t care that they don’t know what they’re doing.”

– Jaime Rogozinski, founder of WallStreetBets, says of its users in The Wall Street Journal’s Playing the Market Has a Whole New Meaning.

As more investors willfully admit they are gambling on stocks, I feel compelled to offer an easy way to make more informed decisions, and, hopefully, save people lots of money. My firm offers research that shows when meme stocks’ valuations get crazy, and investors should sell or stay away. This week, I focus on AMC Entertainment AMC and put it in the Danger Zone.

Why Investors Need Independent Research

Wall Street isn’t in the business of warning investors of the dangers in risky stocks because they make too much money from their trading volume and underwriting of debt and equity sales.

Only independent firms are free to provide unconflicted research and navigate Wall Street conflicts and analyst biases. With new technology to cut through the deluge of data in financial filings and overcome the flaws in Wall Street research, self-directed investors are better positioned than ever to make informed decisions.

What’s the Problem Here?

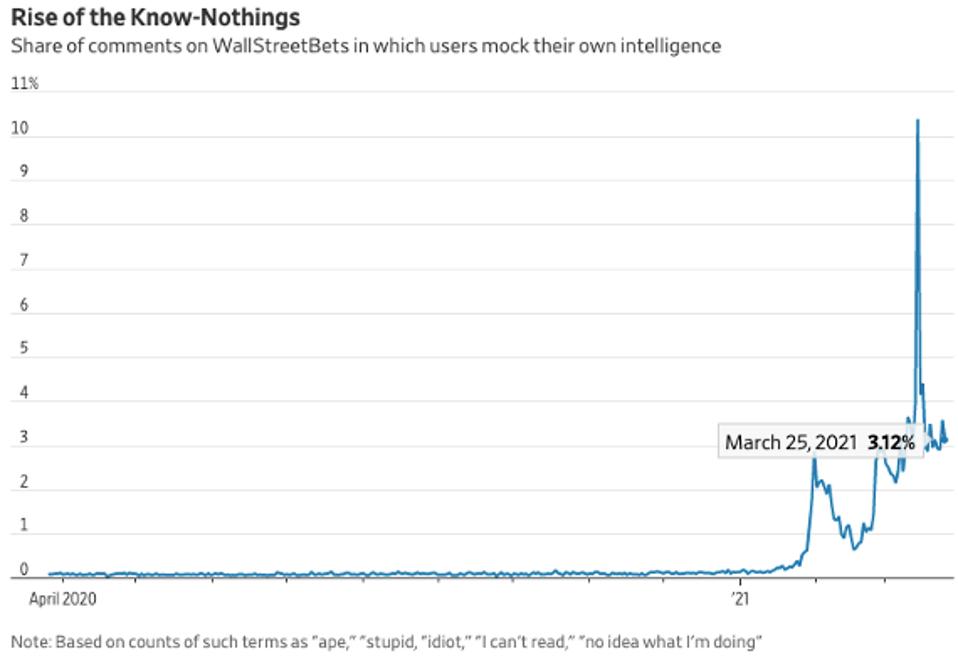

The meme stock frenzy highlights the lack of reliable fundamental research that elevates sources like Reddit to undue levels of influence and leads investors to lose perspective. According to data from TopStonks.com, complied by The Wall Street Journal, the share of user comments in Reddit’s WallStreetBets poking fun at their own intelligence spiked to over 10% in mid-March (up from >1% in early January). See Figure 1.

MORE FOR YOU

Figure 1: Investors Are Gleefully Un-Informed

WallStreetBets users mock their own intelligence

New Constructs, LLC

Without reliable fundamental research, investors have no way of gauging whether a stock is expensive or cheap. Without a reliable measure of valuation, investors have little choice but to gamble if they want to own stocks. The lack of reliable fundamental research is a big problem if we want the market to have integrity and not unfairly advantage those with better information.

Meme Stock #2: AMC Entertainment Holdings: Danger Zone at Any Price

AMC is not worth owning at any price, barring a drastic change to its business model. Given poor fundamentals and a mountain of debt, (221% of market cap) I don’t see how equity investors will have a claim to any future profits, especially given the headwinds facing the movie theater industry.

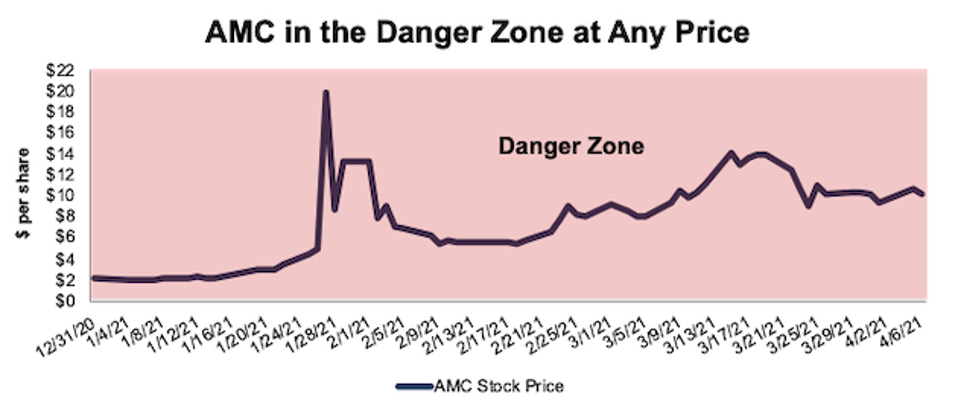

Nevertheless, AMC went on to climb as high as $20/share in late-January before taking a roller coaster path back to ~$10/share. See Figure 2.

Figure 2: Fundamental Research to Know When to Sell AMC

AMC stock price since 12/31/20

New Constructs, LLC

Fundamentals Were Bad Before the Pandemic

Movie theater operator AMC Entertainment had its moment as a meme-stock the same time it was staving off bankruptcy, which illustrates how little the stock’s rise was related to the firm’s fundamentals.

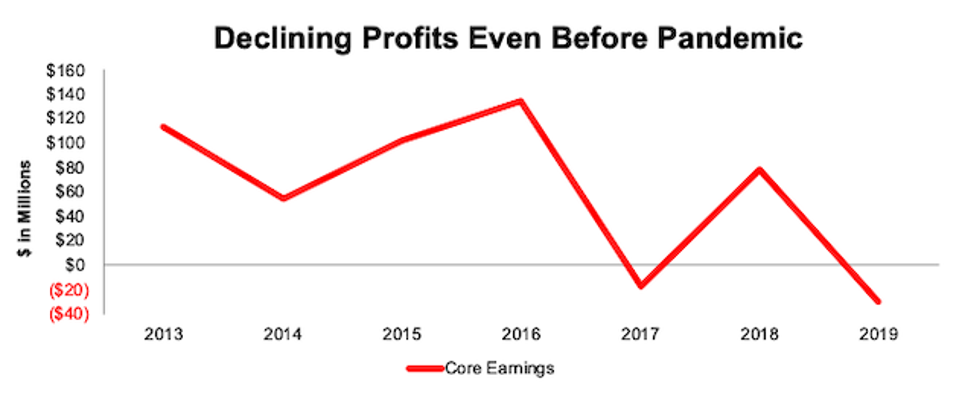

Apart from bankruptcy concerns, AMC’s business operations had been trending in the wrong direction even prior to the COVID-19 pandemic. AMC’s Core Earnings fell from $114 million in 2013 to -$30 million in 2019, per Figure 3. Core Earnings fell to -$1.8 billion in 2020.

The firm burned through $5.2 billion in free cash flow (FCF) from 2014-2019. FCF was -$3.9 billion in 2020.

Given the poor fundamentals, AMC earned an unattractive rating before the meme-stock frenzy took off.

Figure 3: AMC’s Core Earnings From 2013-2019

AMC core earnings since 2013

New Constructs, LLC

Pandemic Headwinds Persist Post-Pandemic

The shift away from movie theaters to streaming could be permanent. When COVID-19 shut down movie theaters across the globe, production studios initially postponed movie releases. As lockdowns persisted, movie studios started releasing their movies on streaming platforms such as Disney+ and HBO Max, often on the same day as in theaters. Gone was the ~3 month exclusive window for theaters to cash in on new releases before they hit streaming platforms.

Now that consumers got a taste of new movie releases at home, there may be no return to the old model. In a survey conducted in May 2020, 70% of respondents indicated they would rather watch new movies at home, even if theaters were opened. Accordingly, Disney began sending movies originally intended for theatrical release directly to its streaming service in mid 2020. Similarly, Warner Bros. announced in December 2020 that it would launch every 2021 movie on HBO Max at the same time as theaters. As David Sims, writer at The Atlantic put it, “audiences will have little incentive to pay more to see these films in theaters.”

However, poor fundamentals and structural headwinds didn’t stop AMC Entertainments’ stock from soaring during the meme-stock frenzy. To give readers a sense of just how crazy-overvalued the stock was at its peak, I do the math and show how the business would have to perform to justify $20/share.

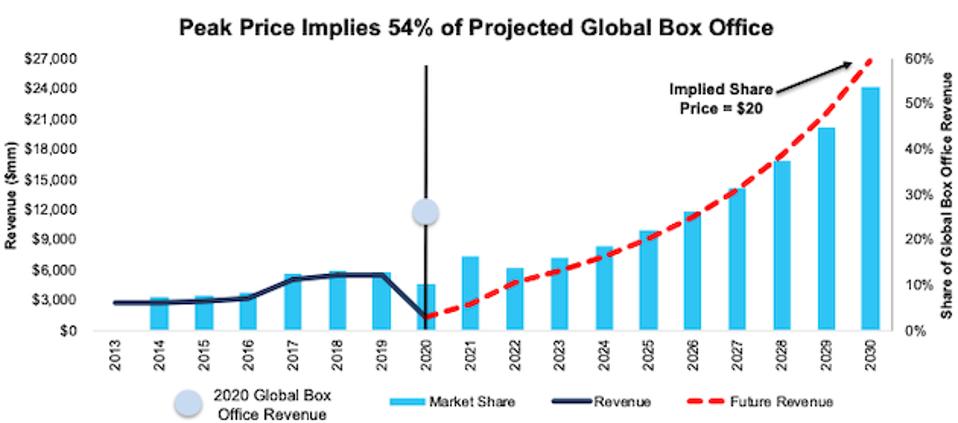

“Crazy” at $20 Explained: Implies Market Share Rises From 13% to 54%

My firm’s reverse discounted cash flow (DCF) model is an excellent research tool for analyzing the expectations implied by stock prices. To justify $20/share, it shows that AMC Entertainment must:

- immediately improve its profit margin to 14%, which equals the highest in company history (2013) compared to 8% in 2019 and

- grow revenue by 36% compounded annually for the next decade, which is based on growing at consensus estimates in 2021 (113%) and 2022 (81%), and 24% each year thereafter (well above 9% consensus revenue estimate for 2023)

In this scenario, AMC Entertainment earns nearly $27 billion in revenue in 2030, which is nearly 5x greater than its previous record revenue of $5.5 billion in 2019 and ~220% of 2020 global box office revenue.

If I assume global box office revenue grows at projected rates from 2020-2025, and grows 3.7% a year (equal to CAGR from 2009 to 2019), from 2025 through 2030, the scenario above implies AMC Entertainment’s revenue would reach 54% of the global box office revenue in 2030, up a good bit from ~13% in 2019.

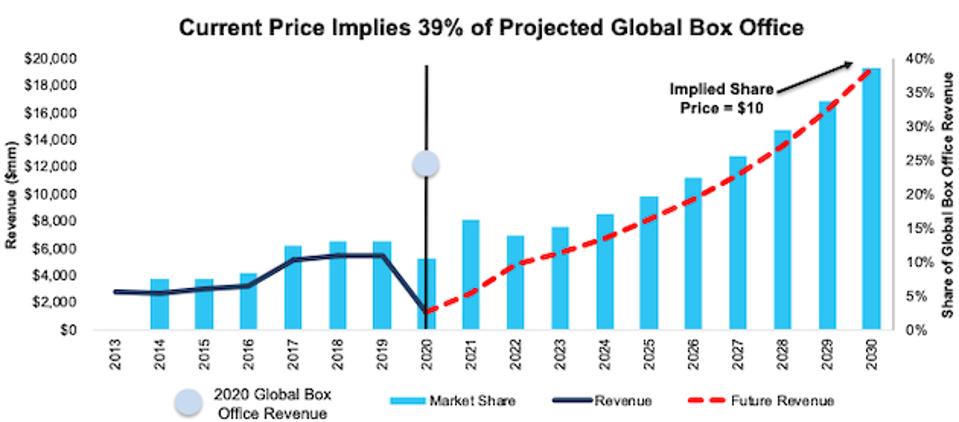

Figure 4 compares AMC Entertainment’s historical revenue and share of the global box office to its implied revenue and share of the 2030 projected global box office for this scenario.

Figure 4: AMC Entertainment’s Implied Revenue and Market Share in 2030 to Justify $20/share

AMC implied Revenue

New Constructs, LLC

Still Crazy: At $10/share

For perspective on the current price, I run the same analysis to show what the company must do to justify $10/share:

- immediately improve its profit margin to 14% (all-time high in 2013) and

- grow revenue by 32% compounded annually for the next decade (which is well above projected box office revenue CAGR of 21% through 2025) revenue

In this scenario, AMC Entertainment’s revenue would be 39% of the estimated global box office revenue in 2030 (based on same assumptions as above). Figure 5 compares AMC Entertainment’s historical revenue and share of the global box office to its implied revenue and share of the 2030 projected global box office for this scenario.

Figure 5: AMC Entertainment’s Implied Revenue and Market Share in 2030 to Justify $10/share

AMC Implied revenue scenario 2

New Constructs, LLC

Stock is Not Worth $1

Given that the performance required to justify $10/share is ridiculous, I dig deeper to see if this stock is worth buying at any price. The answer is no. Given $9.8 billion in total debt, $44 million in underfunded pensions, $40 million in net deferred tax liabilities, and $27 million in minority interests, it is unlikely that the company will ever make enough money to satisfy stakeholders who have higher claims on the firm’s cash flows. In other words, I do not think equity investors will ever see $1 of economic earnings.

Selling Stock to Exploit Gambling Investors

Taking advantage of its ultra-high valuation, AMC sold ~312 million (>2x shares outstanding at the end of 3Q20) new shares in 4Q20 and 1Q21 and significantly diluted investors’ equity stakes.

Now, in March 2021, AMC Entertainment requested authorization in its proxy statement to issue 500 million additional shares. The matter will be voted on at AMC Entertainment’s annual meeting on May 4.

Should shareholders approve, and AMC Entertainment elects to issue those shares, then shares outstanding would increase by nearly 7x in around six months’ time. That’s some serious dilution for an already small piece of the equity claim on future profits. Buyer beware.

More Reliable Fundamental Research on Other Meme Stocks

With a better grasp on fundamentals, investors have a better sense of when to buy and sell – and – know how much risk they take when they own a stock at certain levels.

Last week, I illustrated the extreme risk investors are taking buying GameStop GME (GME). In the coming weeks, I will continue to perform this same analysis on other meme stocks: Blackberry (BB), Express Inc EXPR , Genius Brands (GNUS), Koss Corporation (KOSS), Naked Brands Group (NAKD), and Nokia (NOK). Each of these stocks were on Robinhood’s restricted stocks list and each saw a major rise and fall in late January.

I will also feature other meme stocks that trade at levels entirely disconnected from fundamental reality, such as Netflix NFLX and Tesla TSLA .

Figure 6: Meme Stocks Disconnected From Fundamental Reality

Meme stock tickers

New Constructs, LLC

Disclosure: David Trainer, Kyle Guske II, Alex Sword and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

from WordPress https://ift.tt/3dyaLXv

via IFTTT

No comments:

Post a Comment