close up view of a craps table with dices and fiches (3d render)

getty

Deal Overview

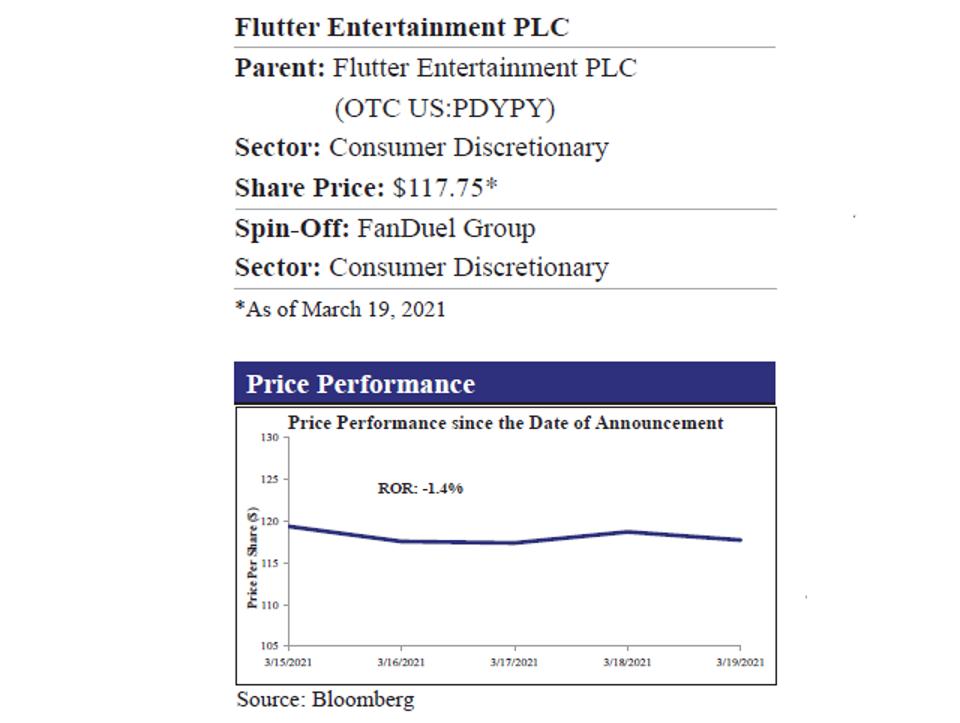

On March 15, 2021, Flutter Entertainment PLC (OTC US: PDYPY, $117.75, Market Capitalization: $41.24 billion) announced that it is considering strategic options for its U.S. business, FanDuel, including partial IPO listing in the U.S. The company’s clarification is a response to the recent press speculation concerning a potential IPO of FanDuel. The company has stated that no decision has been made and notified that further formal announcement will be made once a decision has been made to proceed with a listing in due course. Flutter Entertainment would hold the remaining stake in FanDuel and continue growing as a global sports betting and gaming company. Flutter’s stock price was up nearly 6% on the day of the announcement.

Flutter Entertainment PLC and Price Performance

Spin-Off Research

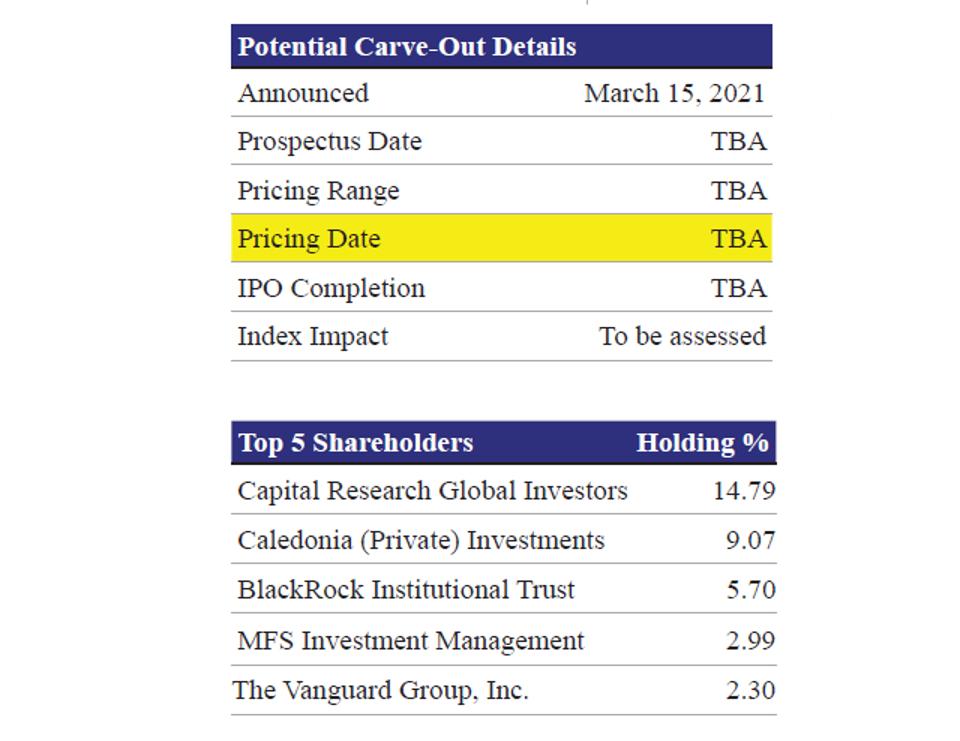

Founded in 2009 as a fantasy sports company, FanDuel has emerged as America’s largest online sports betting business, accounting for around 40% of the market. Flutter completed its merger with The Stars Group in May 2020, and bought a further 37% stake in FanDuel from its early private equity investors in December 2020. The company had previously bought a 58% stake in FanDuel back in 2018. With the recent 37% acquisition, the company raised its ownership stake to 95%. Flutter noted the deal gave FanDuel an enterprise value of $11.2 billion, a discount of over 40% compared to the Enterprise value of DraftKings, a distant second player in the U.S. market.

However, the separation of Fanduel is not straightforward. Fox FOXA corporation, the media giant chaired by Rupert Murdoch, is one of the 10 biggest shareholders in Flutter, owning a 2.6% stake. While Flutter owns 95% of FanDuel, it has an agreement with Fox, under which the latter has the right to acquire an 18.6% stake in the business from June 2021 with an option lasting for 10 years. The agreement dates back to Flutter’s $12.3 billion merger in May 2020 with Stars Group, the Canadian gaming firm, which had a 25-year licence with Fox to use the Fox Bet brand name. Flutter will have to resolve these ownership issues prior to the potential IPO of Fanduel.

Carve-Out Details and Top 5 Shareholders

Spin-Off Research

MORE FOR YOU

Deal Rationale

Flutter’s carve-out of FanDuel is aimed to address the undervaluation of Flutter vis-à vis its peers, as the stock market has perceivably failed to value Flutter’s strong market position appropriately. The company pointed out that its U.S. revenues in 2020 were $896 million, higher than DraftKings ($644 million) and larger than the combined revenues of its two closest peers, DraftKings and PennNational (a casino and racecourse operator). Furthermore, Flutter shareholders have become frustrated that the stock market has failed to value this strong market position appropriately. FanDuel’s closest rival, DraftKings, has a equity market value of $28.6 billion.

Before the share price jump on the day of the announcement, Flutter was valued at £27.7 billion ($38.5 billion). That is not much of a difference in view of the fact that Flutter also owns a multitude of other well-known and profitable betting brands. Accordingly, some investors have been pressing Flutter to spin-off FanDuel, noting that the latter could enjoy a stock market valuation of as much as ~$37 billion, significantly higher than the current market cap of its closest peer DraftKings ($28.6 billion). DraftKings last year made one of the most successful stock market debuts seen in the U.S. It came to market in April 2020 via a merger with a Special Purpose Acquisition Company (SPAC) or ‘blank cheque company’ called Diamond Eagle Acquisition Corp, listed in 2019 at $10 per share. The shares closed on Friday at an all time high of $71.98.

A separate listing of FanDuel will help unlock value and would offer investors the opportunity to buy into a pure-play and market-leading U.S. sports betting and i gaming operator (as well as the FanDuel daily fantasy sports business and pari-mutuel horse racing provider, TVG), without needing to own the current adverse regulatory risk of Flutter shares. The IPO proceeds will accelerate Flutter’s deleveraging process with a partial sale of its stake in FanDuel would erase the bulk of FLTR’s debt. Moreover, the IPO could provide a price discovery mechanism and maximize FOX’s option to acquire an 18.5% stake in FanDuel, valued at market price.

The global betting and gaming market generated £345 billion of gross gaming revenue (“GGR”) in 2019, with an online share of only 13%. The online sector has a long growth runway, with compounded annual growth expected to be 10% until 2024. While there are many exciting market opportunities to pursue, the rapidly regulating U.S. market is arguably the most attractive for the company, and Flutter has already established a leadership position in that market. Recently, Flutter has increased its TAM for its U.S. market to exceed £14 billion ($20 billion) in 2025 as the number of U.S. states preparing to legalize sports betting rise. The increase in spending patterns in states the company has gone live in, such as New Jersey, Pennsylvania, and Michigan, also bodes well for the company. The company now expects online sports betting to be available to 65% of the U.S. adult population by 2025, compared with 50% earlier, and iGaming is expected to be accessible to 16%, compared with 11% earlier. As of Q4, the company had a 40% market share in online sports betting and 20% in iGaming in the U.S. FanDuel sportsbook is live online in 10 states after being launched in Michigan and Virginia. It has now reached almost a quarter of the U.S. population.

Key Data

Spin-Off Research

Company Description

Flutter Entertainment PLC (Parent)

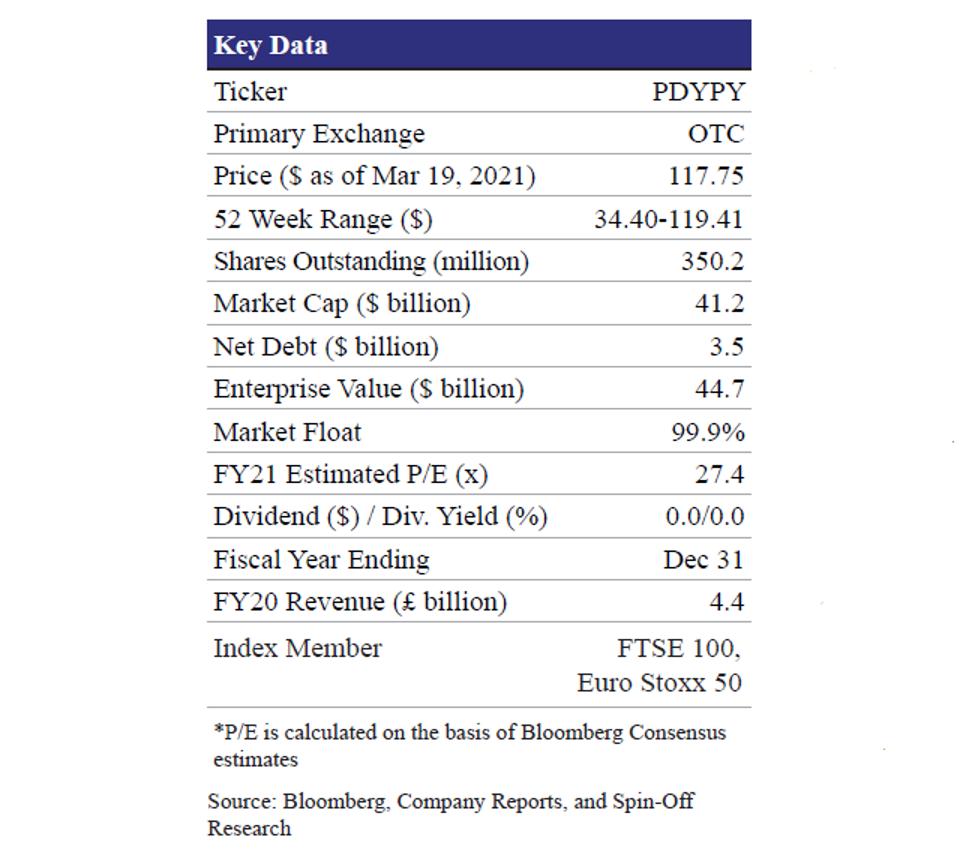

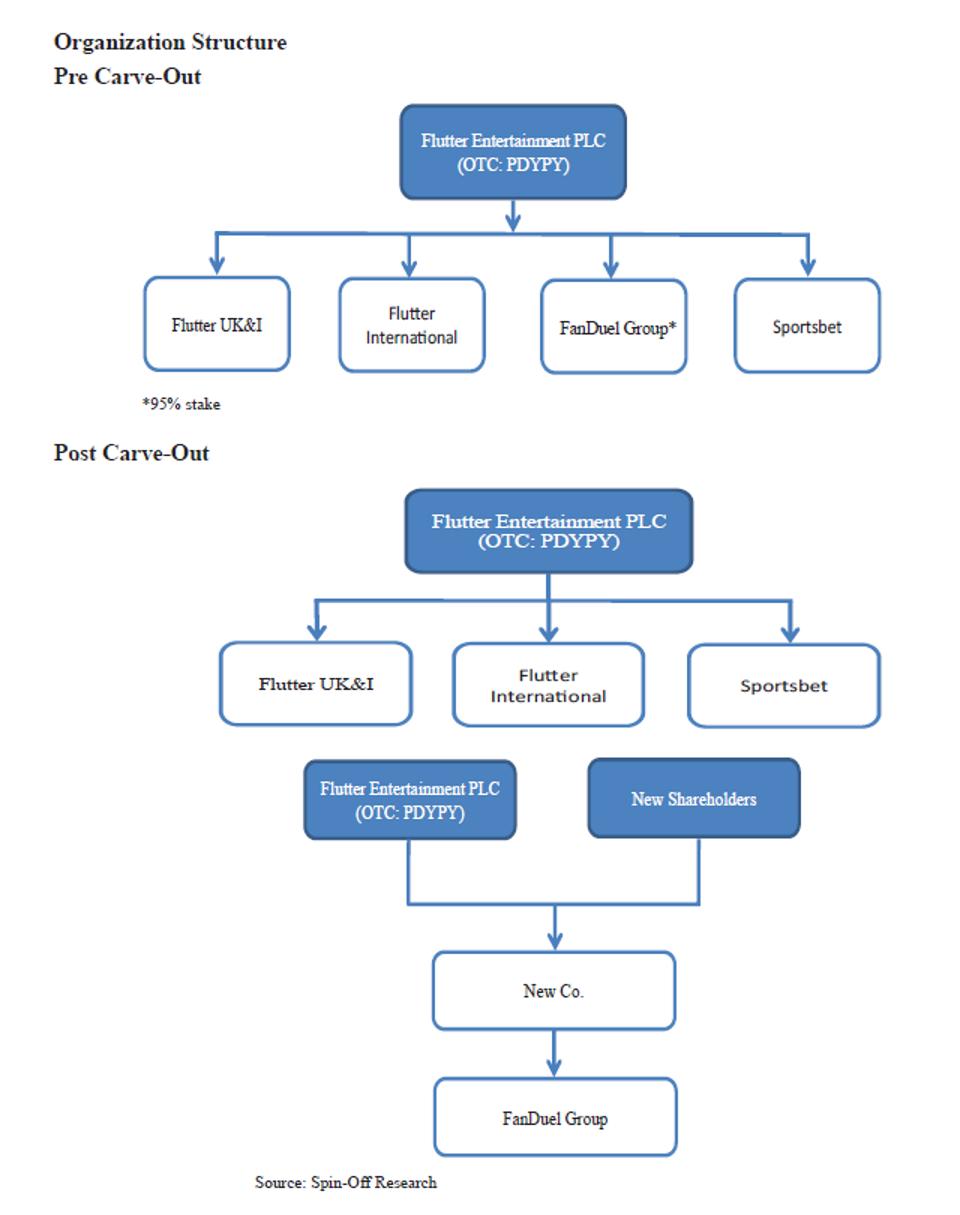

Flutter Entertainment plc (OTC US: PDYPY) is a global sports-betting and gaming company and a constituent of the FTSE 100 and Euro Stoxx 50. Flutter Entertainment plc reports as four divisions: Flutter UK&I, Flutter International, FanDuel Group and Sportsbet. The UK&I division consisting of Paddy Power, Betfair and Sky Betting & Gaming makes up its combined U.K. & Ireland business. The brands mostly operate online, and also includes 620+ Paddy Power betting shops in the U.K. and Ireland. The International division operates in a number of territories around the world and is probably best known for its flagship brand PokerStars, the world’s largest online poker site. Other notable brands include Betfair International, PokerStars Casino, PokerStars Sports, Junglee Games and Adjarabet. FanDuel Group, the company’s U.S. division, consists of FanDuel, FOX Bet, TVG, PokerStars and Betfair brands. The Sportsbet brand is the market leader in online sports betting across Australia. For FY20, the company recorded revenues of £4.4 billion.

FanDuel Group (Carve-out)

The company’s U.S. division consists of FanDuel, FOX Bet, TVG, PokerStars and Betfair brands. The division has a diverse product offering of online and retail sportsbooks, online gaming, poker, advanced deposit wagering on horse racing and T.V. broadcasting. It is the market-leading online sportsbook and casino operator in the rapidly expanding U.S. market and the group is well positioned to continue to take advantage of this opportunity. FanDuel is now offering online sports betting in 10 U.S. states, the latest being Virginia and Michigan, with votes to legalise the practice in other major states, including New York, Texas, North Carolina and Montana, due later this year.

Organization Structure

Spin-Off Research

from WordPress https://ift.tt/2QwWeSL

via IFTTT

No comments:

Post a Comment