Just about this time last year I had a full calendar of events to attend, after spending more than 100 nights during 2019 in a theater, concert hall, conference room or on a field somewhere. Then, as we all remember, the world came to a screaming halt as Coronavirus took hold.

Over the past 12 months I have had innumerable conversations with industry executives, written dozens of articles, hosted dozens of True AF podcast episodes and paid very close attention to the ongoing conversations on Twitter, LinkedIn and industry forums. I was always curious about how people projected the post pandemic future and what constructive steps they were taking to get there.

Here is who I believe got it right:

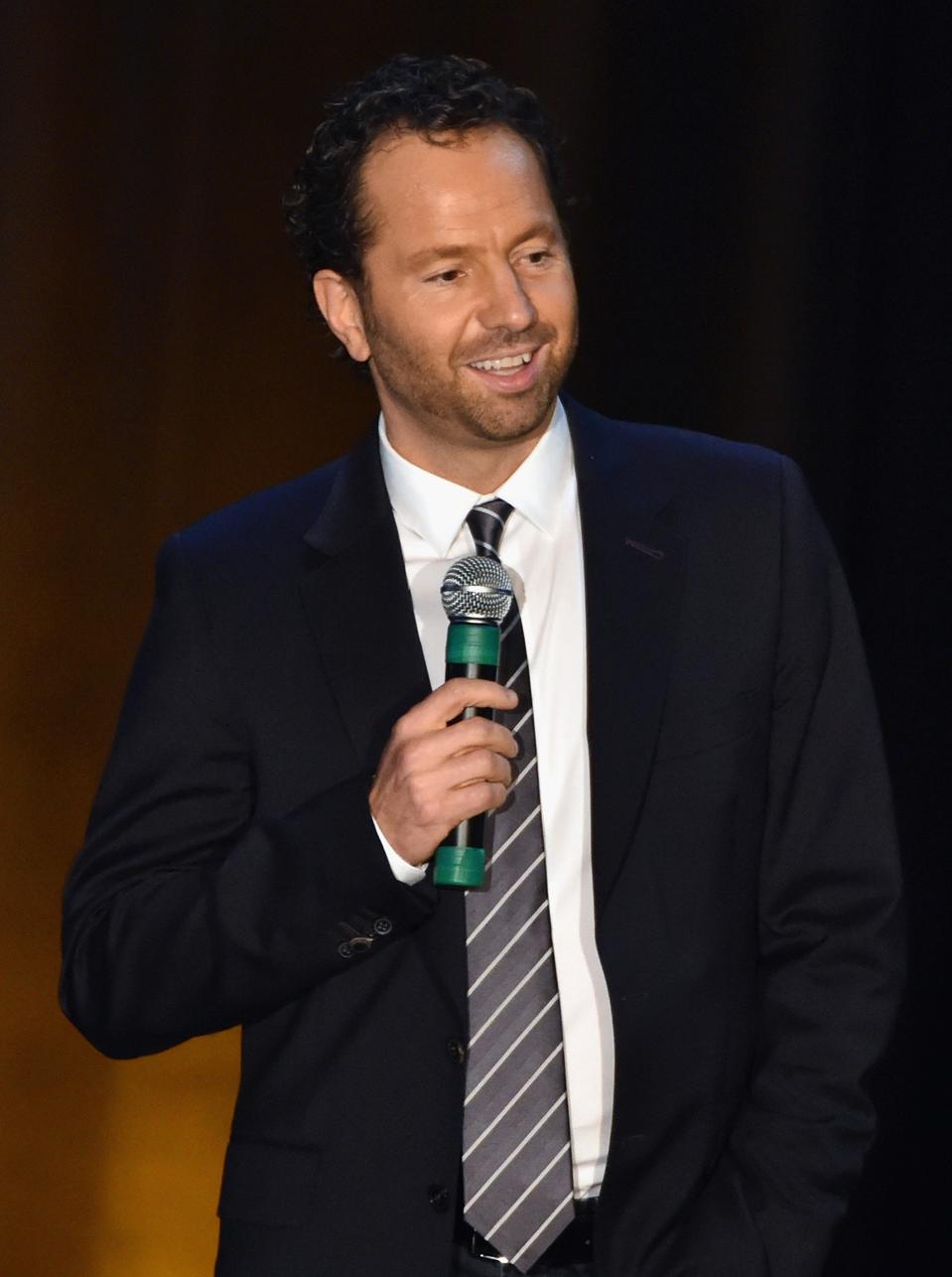

Live Nation

CENTURY CITY, CA – SEPTEMBER 23: Michael Rapino, CEO, Live Nation, (Photo by Kevin Winter/Getty … [+]

getty

When the world shut down, Live Nation’s stock price fell to as low as $21.70. It has climbed back to all time highs in anticipation of the re-opening of live entertainment, rising more than 400% from that low. I believe this is a result of two converging factors. First, Live Nation is the world’s preeminent force in ticketing, tour promotion and venue operations. As such, they are well positioned to lead the resumption of ticketed events from which most of their revenue flows.

However, something else happened quietly during this year lost to Covid. Live Nation found its voice. CEO Michael Rapino consistently led his company in support of the social changes which were rippling across the country. He spoke out clearly, consistently and followed his words with action.

MORE FOR YOU

Rapino’s comments and actions over the past year on gender equality, relief for impacted touring crews, get out the vote initiatives, Black Lives Matter, and offering venues as vaccination sites have shown him to be a leader with compassion. When it was clear Live Nation’s revenues would be severely impacted by the pandemic, Rapino cut his own salary to zero.

Live Nation wields tremendous global influence over live entertainment. They are exiting the pandemic with a new leadership team in place at their Ticketmaster division, and with a growing public perception the company is socially aware. It is refreshing to see a perfectly executed pivot. Pay attention to Live Nation. Their next act may surprise us all.

Shawn “Jay-Z” Carter

LOS ANGELES, CA – MARCH 06: Jay-Z attends the Los Angeles Lakers and Milwaukee Bucks basketball game … [+]

Getty Images

There is a misperception the American Dream is simply bestowed upon the lucky chosen few. That is dead wrong. It’s earned. Want to know how? Study Jay-Z. He is almost a perfect case study of how success comes from hard work combined with networking and a mastery of the business process.

Jay-Z is in the midst of a stunning transformation. In the past month he has sold to Square a majority share in Tidal, the music streaming service, in return for $297 million. Jay-Z will join the Square board and help lead their Seller and Cash App businesses. This deal follows quickly behind the $300 million sale last month by Jay-Z to LVMH of half of his interest in Armand de Brignac, the maker of Ace of Spades champagne. There are two kinds of billionaires on this planet. Those who simply manage their assets and those who are actively causing them to grow. With Jay-Z’s influence rising as quickly as his net worth and cash liquidity, expect more big moves to come quickly.

Oak View Group

AUSTIN, TX – DECEMBER 03: Oak View Group CEO Tim Leiweke attends the groundbreaking ceremony for the … [+]

Getty Images

Oak View Group, led by CEO Tim Leiweke and Board member Irving Azoff is building new venues worldwide. These are modernized versions of the arenas where many teams and acts play. They recently sold naming rights for their about to be constructed Co-op Live arena in for Manchester City reportedly for $125 million over time. Last summer they sold Amazon the naming rights to the former KeyArena in Seattle, which will now be known as the Climate Pledge Arena. Climate Pledge is believed to be the first venue bearing the name of a social cause rather than a corporate entity, team or municipality.

In addition, both through their OVG facilities division and with the Arena Alliance, Oak View has significant influence over arenas, stadiums, convention centers and amphitheaters.

Oak View has also staked a significant position in media and conferences, owning Pollstar magazine and Venues Now and presenting both the Pollstar Live conference and the Venues Now conference. I am somewhat of a conference junkie whose been to everything from the Milken Global conference to the Clinton Global Initiative. I’ve attended Pollstar Live and found it to be very engaging and informative.

As live events resume with the rescheduled events from 2020 and 2021 colliding with those events which were calendared for 2022 and those newcomers seeking venue space, any company with input into who can access performance space will be extremely powerful.

TickPick

Brent Goldberg

TickPick

TickPick is perhaps the smallest of the significant secondary ticket markets. This New York city based company let by Brent Goldberg and Christopher O’Brien has swum against the tide during the past year and appears to be gaining share as a result.

TickPick has made two significant decisions which differentiate it from the giants in resale tickets. First, they display “all-in” prices on their website, so the consumer buying a ticket from them does not get surprised at the check-out page by a service fee they were not expecting. Second, they cultivated their suppliers at a time when many of the major resale markets left them hanging.

Ticket resale markets do not own the tickets they sell. Those tickets are essentially consigned to them by speculators who purchase tickets in hopes they will sell for more than they cost. Until the pandemic hit, the process was, once a sale was made by a resale marketplace which collected payment in full immediately from the buyer, the seller of the ticket would be paid as soon as they delivered the ticket. Because so many events were cancelled or postponed because of the coronavirus, almost every resale market delayed paying for tickets until after the event occurred. This put the entire risk of cash flow upon the ticket owner who had to put money up front to buy the ticket, allow the resale market to have the benefit of receiving the proceeds from selling the ticket while the ticket supplier waited for as much as a year or more to get paid. That is unreasonable and unsustainable.

TickPick figured they knew their suppliers, and they had to work with them. So, when TickPick made a sale and the supplier delivered the ticket, they paid them. Simple. Honest. Game changing. By both standing up for their suppliers and acting more transparently with their customers, TickPick has positioned themselves to grow rapidly in the post Covid resumption of live entertainment.

YellowHeart

Josh Katz, CEO

YellowHeart

YellowHeart was an early entrant into this space, and just completed a successful sale of NFTs (non-fungible tokens) on behalf of Kings of Leon who both sold their new album NFT YOURSELF and tokens which granted four front row seats to every future tour plus VIP benefits during the event. More innovations are coming as YellowHeart’s CEO Josh Katz drives change in the ticketing world.

Non-fungible tokens are the future of tickets. They allow for ownership to be clearly and publicly displayed on the blockchain. That removes fear of counterfeits and duplicate tickets being sold. Blockchain smart contracts control how content creators and artists to retain a profit participation in subsequent sales of tickets, relieving the pressure from creators about selling a ticket to an event for $100 and watching someone entirely unrelated to the event to make all the money off reselling that event’s access. With NFTs a designated profit share goes back to the artist and creative team.

I remember when the first fax machines came out, and I just could not imagine how you could feed a piece of paper into the machine in one city, and it would come out perfectly the same seconds later across the world. NFTs are sort of the same leap of faith. They are only complicated until you use them. Once tickets just populate onto your smart phone, you will find buying an NFT is as routine as texting someone to ask if they can take a call. It is the opposite of what you know now, but will be your future, and soon.

Vivid Seats

Stan Chia, CEO VividSeats

.

I was born in Chicago, so going to visit my friends over at Vivid Seats is always a little bit of a trip home. Regardless, over the years I have been continuously impressed by the rigor with which Vivid built its business. They were always on point with the technical aspects of operating their system. In a world which is becoming ever more interconnected, having a functional integration of a secondary market, a point-of-sale system, and the teams to assure that events are listed quickly and correctly are critical to building both a consumer base and broad group of suppliers. In addition, they have solid relationships with the VC community.

I was surprised when Stan Chia was selected to become Vivid’s CEO a little more than two years ago, because at first, I didn’t see the connection between selling event tickets and his building out the delivery network as COO of GrubHub. I was wrong. Both businesses are about customer service and scale.

It was once as unimaginable to buy a concert ticket over the internet as it was just recently that a guy with a backpack could ride a motorcycle to my hotel to deliver fresh ramen. Almost everything on the planet can be ordered from a phone and often delivered within the hour. Tickets, in electronic form arrive in seconds. The winners in the space compete in three ways: price, selection and reliability.

Vivid is on the Amazon model, building out its logistics so the consumer is rarely, if ever disappointed. That is no surprise. Stan Chia previously held a senior role at Amazon, and also senior roles at Cisco and General Electric. His past is not just a resume. Chia is someone whose career prior to Vivid was the equivalent of going to CEO bootcamp. I expect Vivid to find their way into some facets of the primary ticketing world soon. There is a lot of room there for new entrants outside the concert space.

Marcus Stern

Marcus Stern

.

Marcus Stern along with his partners Chris Bonner and Deric Margolis own Anytickets which grew to be one of the largest suppliers of tickets to resale markets in North America. For 2021, prior to the pandemic shutdown, their projected revenues were $250 million.

I liked Marcus from the first minute I met him. His reputation was impeccable. But, more importantly, you can tell instantly that Marcus is the kind of guy whose word is his bond. If Marcus promises something, you don’t need to get it in writing. In the competitive and sometimes jealous world of ticketing, it’s refreshing to see there is someone who is almost universally liked and trusted.

Anytickets, from a small facility in Houston, managed a major crisis when Covid-19 shut down events worldwide. They had a $40 million line of credit from Bank of America, plus their own capital invested into a broad portfolio of tickets. Those shows were not going to happen in 2020, and as we now know, unlikely to happen in 2021. In addition, many of the tickets which had been sold over the six months prior to the Covid shutdown were for events which were still in the future, which meant they were likely going to cancel and all the profits which had been booked and reinvested were going to be clawed back. Meanwhile, there were season ticket subscriptions to maintain, and a quite nervous bank to appease.

This is a small-scale version of what airlines faced, and they got two separate multi-billion-dollar rescue packages from the government. Anytickets had to redeploy its team to recovering refunds for shows which canceled and repaying profits they had received for those canceled to the markets where they sold. Collecting refunds for tickets which canceled or postponed is labor intensive. Some events refused refunds like the Country Music Awards show, merely rolling the tickets forward into 2021, and then again to 2022 leaving the owner of the ticket without any option to recover their money. Some had a short window to claim a refund before defaulting to a credit in the future. At scale, this was a test of management.

Now, a year later, Marcus and the team at Anytickets are ready to scale back up as events come online. It is not obvious what will happen next. There is certainly pent-up demand for live events, but how many people are willing to go out to more than one or two concerts or games in the next year? There are going to be a lot of choices as artists have been left without any revenue from live performance for at least 18 months before anything can start at scale. We saw little interest on the part of fans to go to games when seating capacity was limited. After nearly two complete seasons of watching games at home, has the fever broken to attend sporting events in person? Would you bet $40 million on whether baseball teams can fill a stadium or which artists who sold tickets in 2019 can still sell them for shows in 2022?

The secondary ticket markets are dependent on people like Marcus for their supply. Without supply, the secondary market grinds to a halt. The secondary markets made it possible for consumers to always have access to tickets. As events return, we need guys like Marcus and the Anytickets of this world to stay at the table and smooth out supply.

“The Three Shades:” Dave Wakeman, Tony Knopp and Don Shano

The Three Shades

.

Auguste Rodin, the French sculptor, was inspired by Dante’s Divine Comedy, in which the damned souls standing at the gates of Hell were known as “shades” pointing at a warning to “abandon hope, all ye who enter here.” Rodin famously cast The Three Shades as identical figures together from different angles, all pointing at this spot. Advising the world of live entertainment this past year has not been all that different than that which the shades faced. This year ain’t been easy for anyone.

1. Dave Wakeman

Dave Wakeman has been everywhere during the pandemic. As the world melted like it was a Salvador Dali surrealist painting, Dave kept posting thoughtful conversation points. His experience in designing and implementing marketing strategies showed as he pointed out how the post pandemic experience would differ from what we knew in 2019.

Dave is active on Twitter. He publishes weekly newsletter Talking Tickets, and he is recording episodes of his podcast The Business of Fun.

But, mostly, Dave’s been truthful about what the post pandemic environment will be for live events.

He and I both believe that almost nothing we learned in the past will apply in the future. Marketing of live events has changed, like it or not. The old rules of no refunds take it or leave it, you’re lucky to even get a ticket are in the rear-view mirror. We have been refunding tickets for nearly a year. Even airlines are more flexible now. Consumer expectations have changed. Dave is focused on strategy and having a big picture view of the future. He has never lost sight of the fans and his belief that unless fans are treated well, there will be recovery. Dave is one of those guys on my short list of who I bounce ideas off because he is thoughtful, knowledgeable, and willing to see things as they are rather than as they were or as he wished they could be.

2. Tony Knopp

Tony is CEO and Co-Founder of TicketManager. He has been very public during the pandemic posting a weekly video of “three things” on YouTube and other platforms. These are lessons in business and ethics he shares from his personal experiences in the entertainment world, from his days at StubHub and over the course of building TicketManager.

Giving advice is hard. Giving advice in public is harder, because it opens you to all comers who have a different opinion or agenda. Tony’s videos are short, factual, empathetic and share with us all that the path to success contains many false starts, disappointments, impossible choices and decisions based upon unknowable future events. Three minutes or so is a good trade-off of time for information. I try to stay current on whatever Tony has to say because it helps keep me grounded, which is perhaps the point of the exercise.

3. “Don Shano”

The anonymous author behind the cartoon avatar is a well-informed player in the secondary ticket market. He is a constant presence on Twitter advocating for free markets, chastising bad decision making related to pricing anomalies, no you see it, now you don’t ticket transferability and the unfathomable behavior of certain sports teams’ ticket office decision making. “Shano” has a deep network of people providing him current information as articles publish or prices move, and he shares that information with the public through his postings. During the pandemic he has kept careful track of the percentage limits imposed in certain states or stadiums for attendance and updated those reports as changes are made. He writes with a light touch and perfect grammar.

Bob Lefsetz

Bob Lefsetz is amazing. He writes a thoughtful piece related to music or entertainment every day, sometimes more often. He wrote 35 pieces in February and 20 so far this month and it is only the 16th of the month. The Lefsetz Letter is free, frequent and fully informative. There is never any reason to guess what Bob might think about something. Give it a day or two. Your answer will appear by email in his next letter. Just plan to have a little less time to sleep each night because Bob’s writing will get you thinking and you’ll never be at a loss for more – he’s prolific.

from WordPress https://ift.tt/30UcPBG

via IFTTT

No comments:

Post a Comment